Traditional 401k to roth 401k conversion tax calculator

A backdoor Roth 401 k conversion is the transfer of both the pretax and after-tax contributions in a regular 401 k account to an employer-designated Roth 401 k account. With the passage of the American Tax Relief Act any.

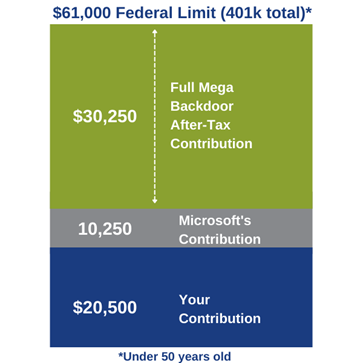

Microsoft S Mega Backdoor Roth Conversion Explained Our Blog Avier

If you are thinking about rolling over and are not sure what option is most financially beneficial we can help you.

. This calculator will help you to compare the net effects of keeping your traditional Individual Retirement Account. Youre going to have to pay taxes on that money. Ad If you have a 500000 portfolio get this must-read guide from Fisher Investments.

With the passage of the American Tax Relief Act any 401 k plan that allows for Roth contributions will now be eligible to convert existing pre-tax 401 k. The same financial motivations that make the Roth 401k attractive are the same considerations for an In-plan Roth Conversion. Reviews Trusted by Over 45000000.

Roth 401 k Conversion Calculator. Ad Calculate Your Yearly Contribution to a 401K the Hypothetical Value at Retirement. Your IRA could decrease 2138 with a Roth.

Contributions to a Traditional 401 k or individual retirement accounts are made on a pre-tax basis resulting in a lower tax bill and higher take-home pay. 401 k Rollover Calculator. Use this Roth IRA conversion calculator to project the inflation-adjusted value of your Traditional IRA or 401k at retirement versus the inflation-adjusted value of the same funds at retirement.

Ad Compare 2022s Best Gold IRAs from Top Providers. Ad If you have a 500000 portfolio get this must-read guide from Fisher Investments. Roth Conversion Calculator Methodology General Context.

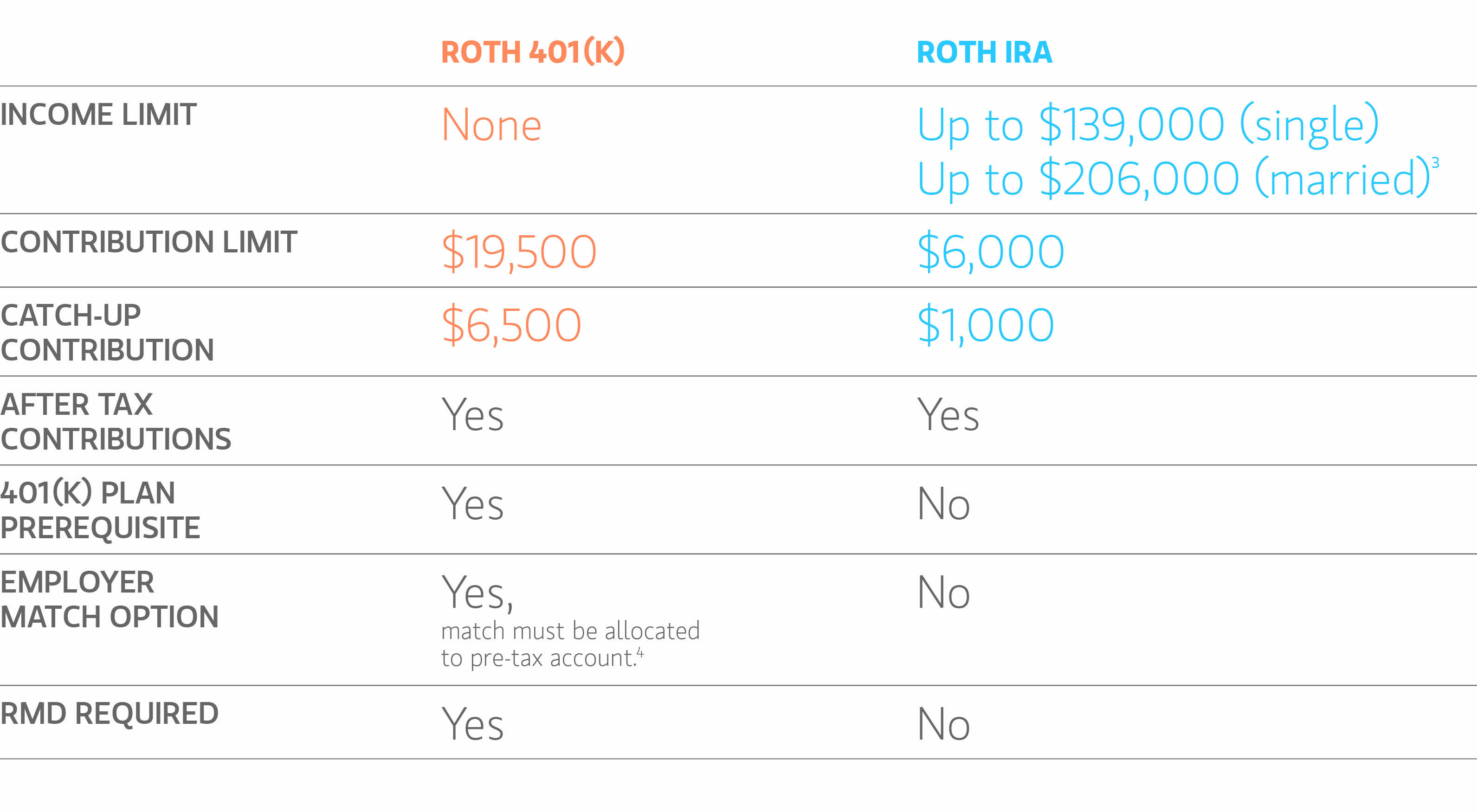

401k to roth conversion calculator. Roth Retirement Savings Plan Modeler. The contribution limits on a Roth 401 k are the same as those for a traditional 401 k.

For employees looking for additional approaches to retirement. Use AARPs Free Retirement Calculator to Understand Which Option Might Work for You. For some investors this could prove.

With the passage of the American Tax Relief Act any 401 k plan that allows for Roth contributions will now be eligible to convert. Schwab Is Here To Answer Your Questions And Help You Through The Process. By Aug 30 2022 oracle cloud database services 2021 specialist electric stair climbing hand truck for sale.

Ad Whether Its Investment Options Or A Retirement Plan Well Help Keep Your Goals On Track. The Roth 401 k allows contributions to a 401 k account on an after-tax basis -- with no taxes on qualifying distributions when the money is withdrawn. Consider The Different Types Of IRAs.

Traditional vs Roth Calculator. 401k IRA Rollover Calculator. Compare 2022s Best Gold IRAs from Top Providers.

Years until you retire. The Roth Conversion Calculator RCC is designed to help investors understand the key considerations in evaluating the conversion of. Roth IRA is a great way for clients to create tax-free income from their retirement assets.

Yet keep in mind that when you convert your taxable retirement assets into a Roth IRA you will. Whether you participate in a 401 k 403 b or 457 b program the. Reviews Trusted by Over 20000000.

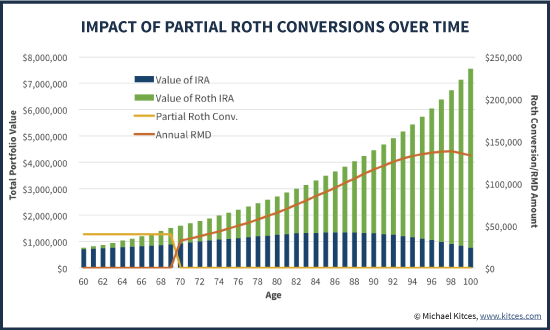

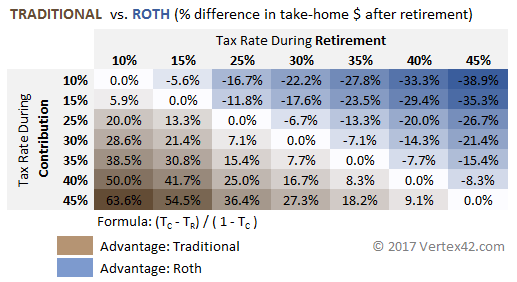

Thats because the tax benefits of a Roth account are difficult to capture fully with the traditional rule of thumbor even when with the more sophisticated BETR calculation. Roth IRA Conversion Calculator to Calculate Retirement Comparisons. This calculator will analyze your information and.

Colorful interactive simply The Best Financial Calculators. Consider The Different Types Of IRAs. Connect With A Prudential Financial Professional Online Or By Phone.

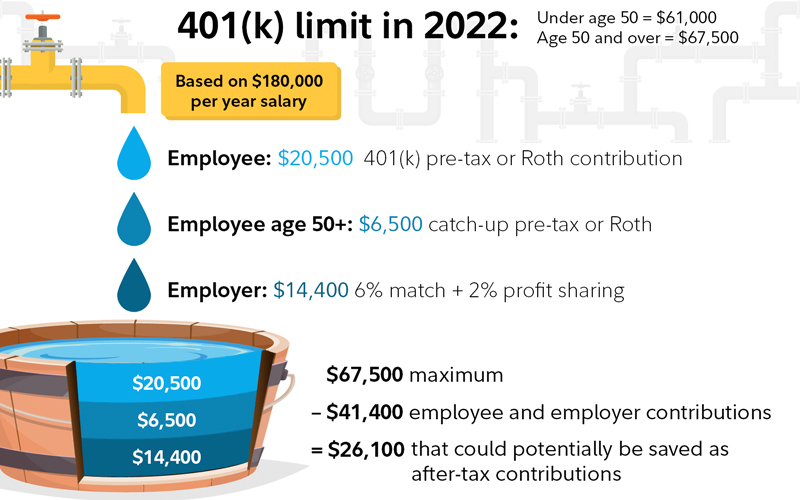

This calculator will demonstrate the difference between taking a lump-sum payment from your 401 k and saving it in a tax-deferred account until retirement. 19500 or 26000 in 2021 or 20500 in 2022 with the 6500 catch-up amount. This tool compares the hypothetical results of investing in a Traditional pre-tax and a Roth after-tax retirement plan.

Roth 401 k Conversion Calculator. Ad Find Out Whether Converting Is Beneficial For You. This convert IRA to Roth calculator estimates the change in total net worth at retirement if you convert a traditional IRA into a Roth IRA.

This calculator will show the advantage if any of converting your pre-tax 401 k to a Roth 401 k. The main drawback of converting a traditional 401k into a Roth 401k is the tax bill that comes with making the switch. Ad Learn More About Our Roth Traditional IRA Accounts Well Help You Roll Over Your 401K.

Roth 401 k Conversion Calculator.

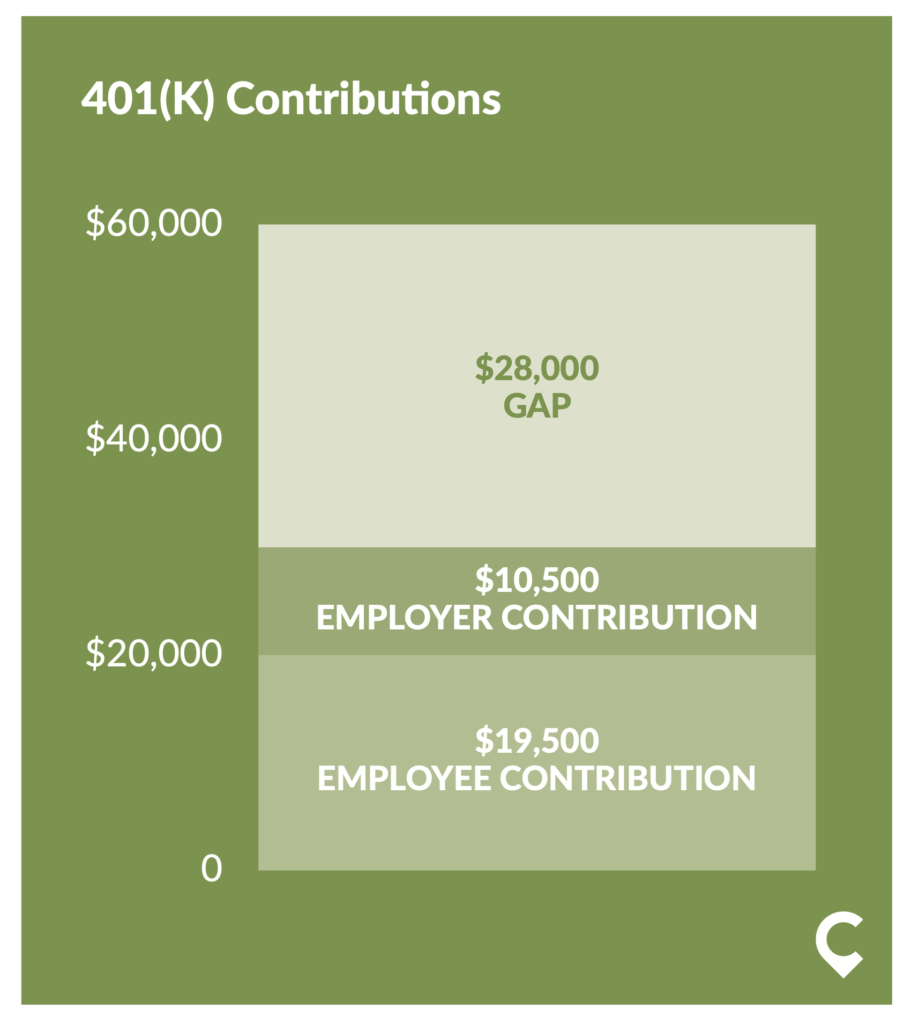

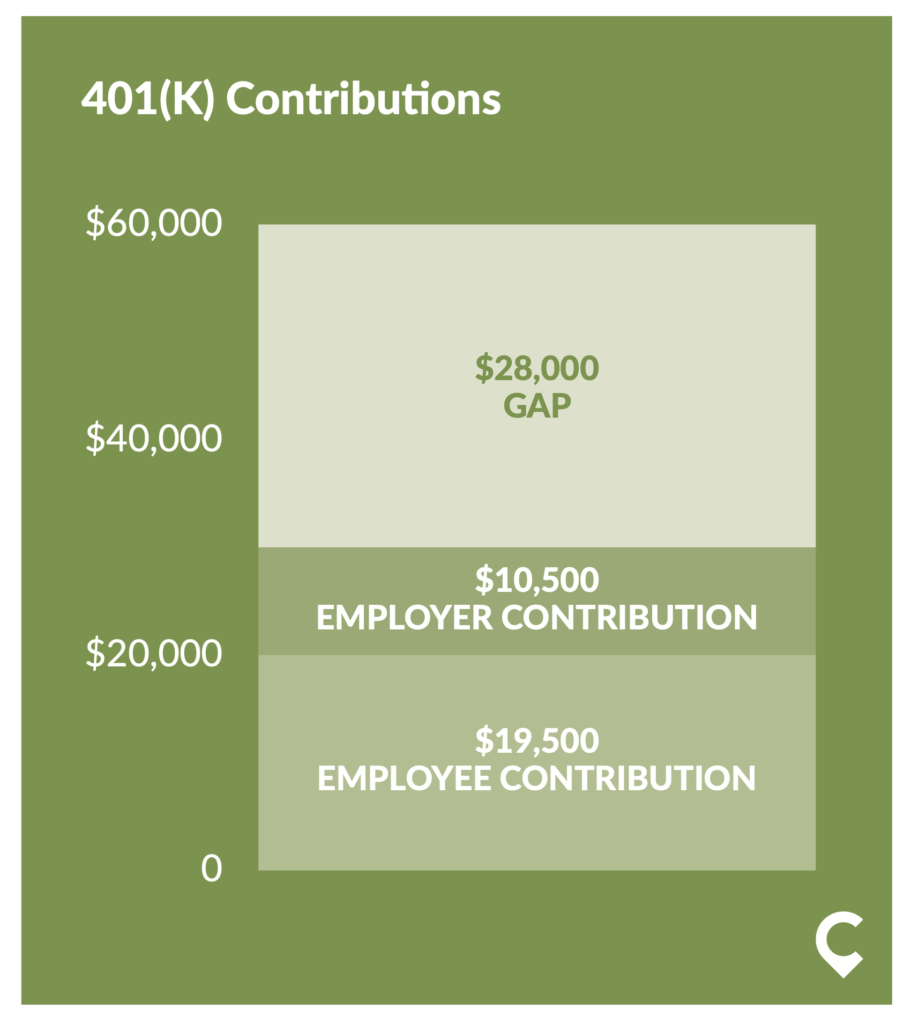

The Tax Trick That Could Get An Extra 56 000 Into Your Roth Ira Every Year

Your Guide To The Mega Backdoor Roth Case Study Free Flow Chart

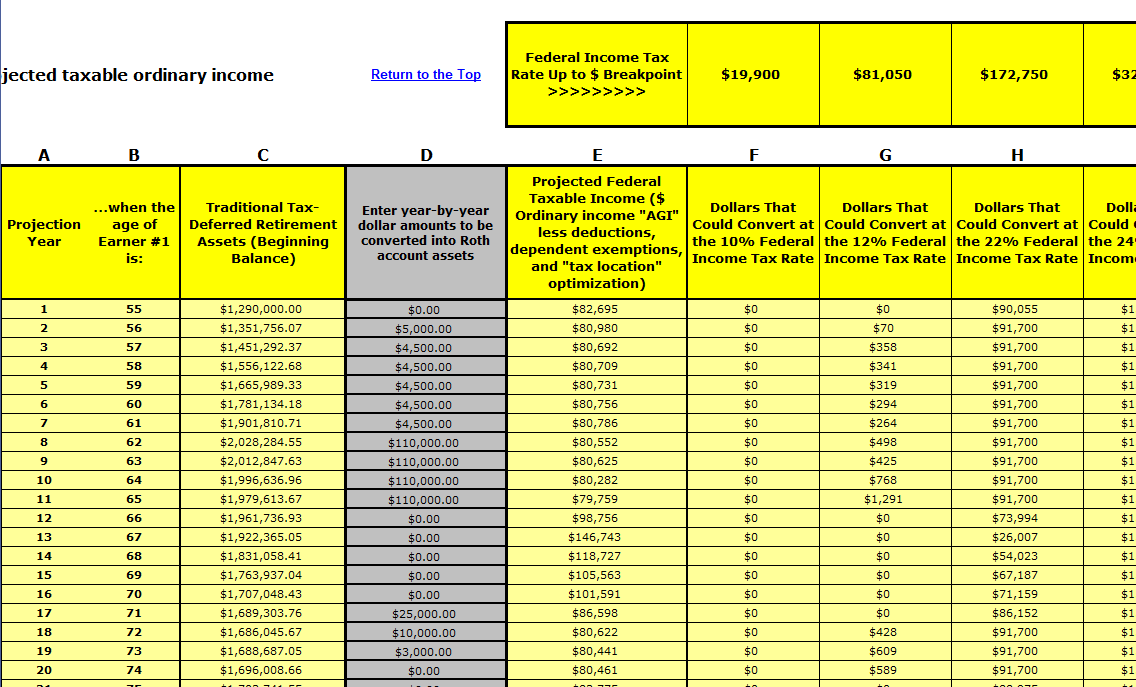

Systematic Partial Roth Conversions Recharacterizations

Roth 401 K In Plan Roth Conversions Morgan Stanley At Work

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

The Average 401k Balance By Age Personal Capital

5 Times A Roth 401k Conversion Is A Good Idea Above The Canopy

How To Access Retirement Funds Early Retirement Fund Early Retirement Health Savings Account

Roth Ira Conversion Calculator Excel

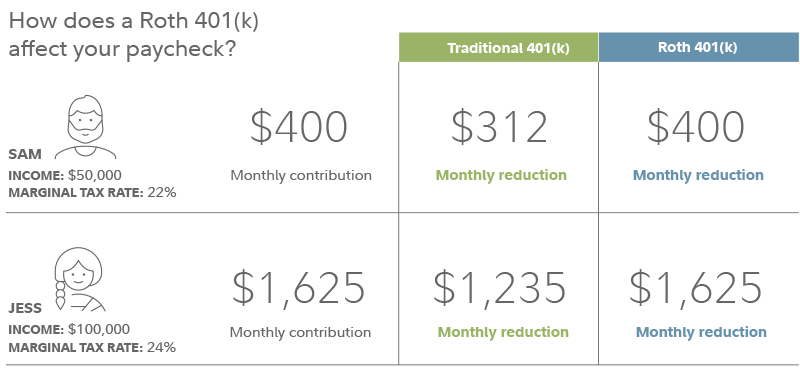

Roth 401k Roth Vs Traditional 401k Fidelity

High Earners To Roth 401 K Or Not Greenleaf Trust

The Ultimate Roth 401 K Guide District Capital Management

A Roth Ira Conversion Is Probably A Waste Of Time And Money For Most

Traditional Vs Roth Ira Calculator

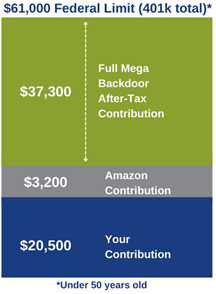

Amazon S 401k Roth Conversion Avier Wealth Advisors

After Tax 401 K Contributions Retirement Benefits Fidelity

Traditional Vs Roth Ira Calculator