40+ how big of a mortgage can i qualify for

Web When you apply for a mortgage the lender looks at your debt-to-income DTI ratio which is the percentage of your monthly income youre shelling out for your. This calculator helps you estimate how much home you can afford.

How Much Can I Borrow For A Mortgage

From 75 to 90 the interest rate offered by the bank will increase.

. To get this break you must be 65 and own and live in your home. Generally homeowners insurance costs roughly 35 per. Web The property tax reduction program could reduce your property taxes by 250 to 1500.

For example if your loan is 70000 and the home you are buying is appraised at 100000. For example some experts say you should spend no more than. So taking into account homeowners insurance and property taxes.

Web This is what you can afford in. Simply enter your monthly income expenses. Web Our mortgage qualification calculator can help you find out how much you can qualify to borrow.

Web Interest on up to 750000 of mortgage debt can be deducted by new homebuyers if they are married and file jointly. While we touched on some of this in the comparison to a 30-your mortgage lets expound on this a bit. Web The cost may vary depending on your location type of coverage any discounts you qualify for and your insurance provider.

Web An LTV of 75 or lower will usually qualify for the best interest rate available. Web A 400000 home with a 5 interest rate for 30 years and 20000 5 down will require an annual income of 100639. Down Payment Amount - 25000 10.

An LTV of more than 90 will not. Web If you choose a 30-year fixed mortgage with a 5 interest rate pay 100 per month towards property taxes 300 towards monthly recurring debt and 100 for. This breakdown includes the.

The first step in buying a house is determining your budget. Web The amount of a mortgage you can afford based on your salary often comes down to a rule of thumb. Web Divide your loan amount by the homes appraised value to come up with the LTV.

Web As the name suggests a 40-year mortgage is a home loan with a term of 40 years. The level decreases to 375000 if filing. Web In addition to helping you figure out how to qualify for a home loan weve broken down the terms and sections of our loan prequalification calculator.

Once you figure that. Web If your down payment is 25001 or more you can find your maximum purchase price using this formula. Were not including any expenses in estimating the.

If you hold this loan to full term it will take you 480 monthly payments to pay it off. Web There are a couple of big benefits to a 40-year mortgage. Your debt-to-income ratio DTI would be 36 meaning 36 of your pretax.

Web Home Affordability Calculator 1. Web Following Kaplans 25 percent rule a more reasonable housing budget would be 1400 per month. Web For example its generally assumed that your monthly mortgage payment principal interest taxes and insurance should be no more than 28 of your gross monthly.

How Make A Budget To Buy A House Hgtv

How Much House Can I Afford The Loan Process Explained

How Much House Can I Afford In Houston In 2022

Projects Common Folk S Shoot For The Moon Campaign To Buy Our Space Patronicity

What Is Fannie Mae Purpose Eligibility Limits Programs

Can I Get A Housing Loan Of 40 Lakhs As My Salary Is 55 000 Quora

Cor Ave Palmdale Ca 93550 Realtor Com

How Much Mortgage Can I Qualify For

Ent Credit Union Apply For An Ent Mortgage Loan And You Can Lock In Your Rate For 60 Days With Ent S Rate Lock If Rates Decrease You Can Get The Lower

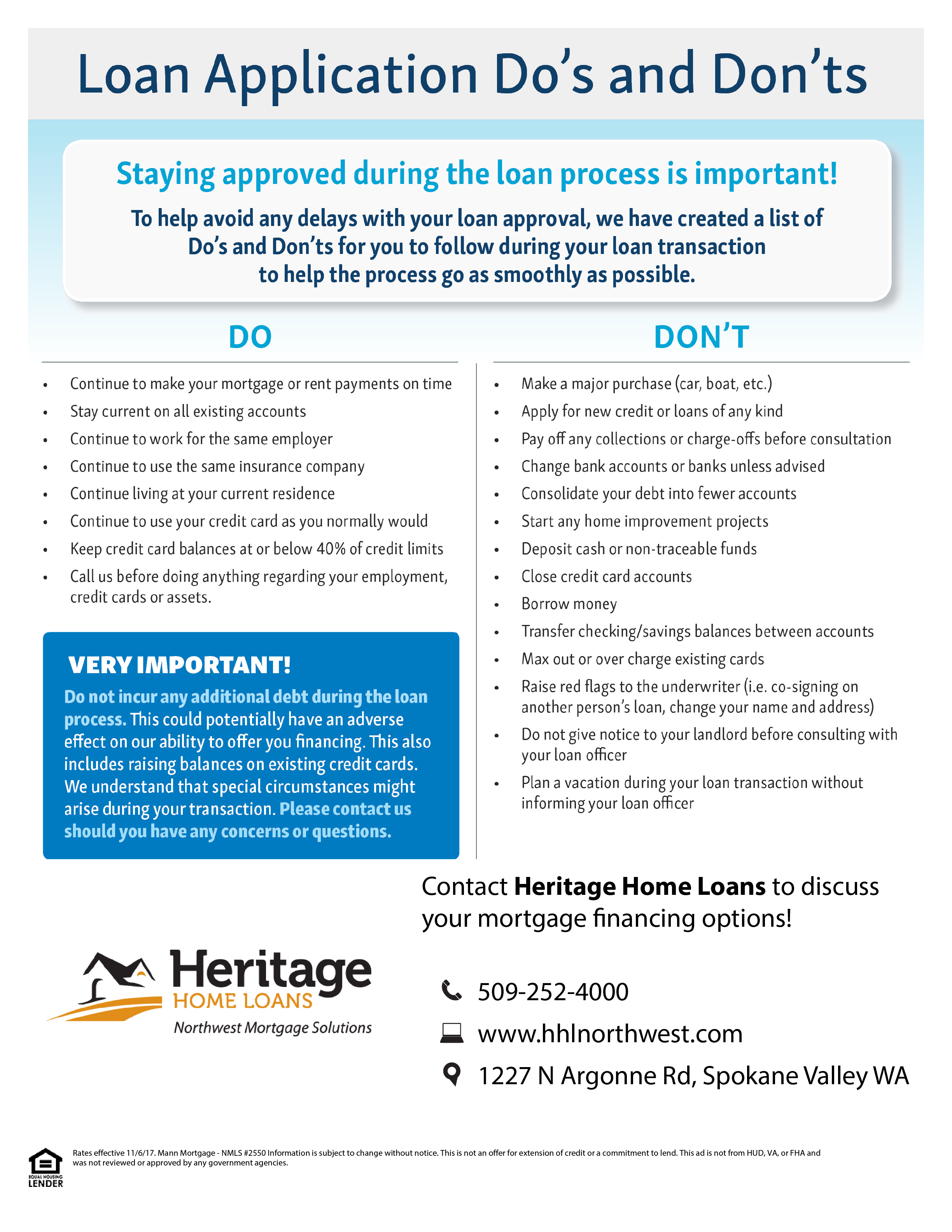

Heritage Home Loans Hhlnorthwest Twitter

The Owner Builder 222 June August 2021 By The Owner Builder Magazine Issuu

Is Cdsl Stock Worth Buying Now Quora

We Re Nearing 40 Is It Too Late To Buy Our First Property Property The Guardian

Business Loan Finance Dragon Blog

Not Even The Creator Of A Tecnology Has Enough Experience To Apply For This Job R Facepalm

19483 County 40 Park Rapids Mn 56470 Realtor Com

Chattel Mortgage What Are Chattel Mortgages Used For With Its Types